The Quoting Conundrum: Why Offsite Construction Pricing Is Still a Maze

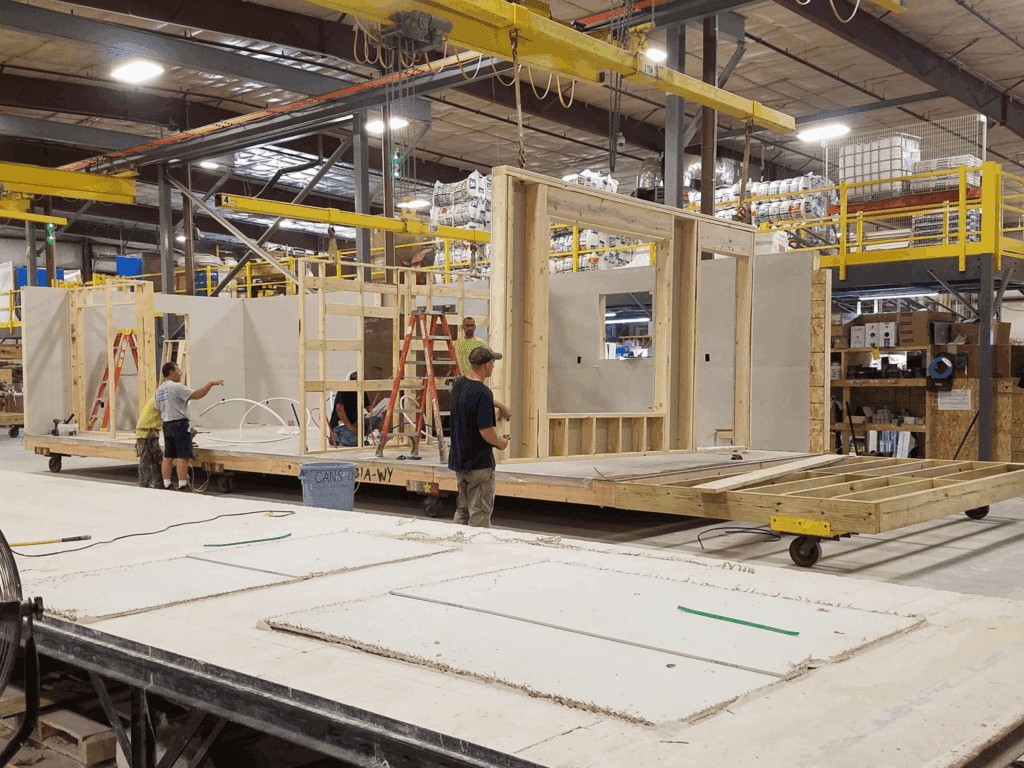

Even after decades in this industry, I still find myself shaking my head at the quoting process most offsite factories use. Recently, my business partner and I were involved in trying to get three factories to quote on a project. It should’ve been simple: we handed over the same complete specs to each. What we got back was anything but clear — and that’s being polite.

One factory replied within a day, one took a week, and one landed somewhere in between. All three sent us quotes. Only one of them actually addressed the specifications we provided. The others seemed to rely almost entirely on their preloaded standard templates, with minimal effort to adapt them to our project.

It was like asking three bakers for a wedding cake and getting back one wedding cake, one birthday cake, and one loaf of bread with frosting on it.

Then came the real time drain: trying to compare them.

Apples, Oranges, and Mystery Meat

Hours upon hours went into lining up each quote side by side, translating vague line items and deciphering what was included, excluded, or just assumed. Freight? One included it. One didn’t. One bundled it under “miscellaneous.” Taxes? Same mess. Set and installation? Two mentioned it but only one priced it. And nobody seemed to define their post-production charges the same way.

The kicker? One quote came in almost 20% higher than the other two, and even after decades in this business, we couldn’t figure out why. If my partner and I can’t untangle this, how in the world is a developer or builder supposed to?

So what do they do? Most likely, they stick with the one factory they’ve worked with before—the one that at least confuses them the least. That might feel safe, but it can easily cost them money and flexibility down the road.

The Missing Link: Architects Who Don’t Speak “Factory”

Adding to the chaos is what I call the elephant in the room: the Architect. Most architects hired to design these projects have little to no knowledge of what the factory can actually produce. Their drawings often ignore the limits of the production line, leaving factories to either over-engineer the quote or omit critical pieces entirely. Both options lead to incomplete or misleading pricing.

This misalignment between design intent and manufacturing capability is one of the biggest reasons factory quotes come back as vague jigsaw puzzles instead of clear offers.

Why This Matters: Trust and Transparency

In an industry trying to win over developers, municipalities, and financiers, this is more than an annoyance—it’s a credibility problem. If factories can’t clearly show what they’re quoting, how can they expect anyone to trust their numbers?

Developers want to know two things:

- What am I getting?

- What will it cost me, soup to nuts?

Right now, too many quotes only answer half of those questions, and usually in fine print.

Fixing the System: Five Ideas

Here’s how the industry could start pulling itself out of this mess:

1. Create a Universal Quote Template

Imagine if every factory used a common framework that broke down every project into the same categories—structure, finishes, MEP systems, site setup, freight, taxes, and contingencies. Each factory could still plug in its own numbers, but at least the structure would be consistent.

2. Require Clear Inclusions and Exclusions

Quotes should have a mandatory section that spells out what is not included. If freight isn’t included, say it. If sales tax varies by state, note it. If installation is only “assisted set,” explain that.

3. Build Customer-Facing Configurators

Factories should invest in customer-friendly quoting software that pulls in their standard options but allows for project-specific specs. It shouldn’t take a trained engineer to figure out what a wall costs or whether it comes pre-wired.

4. Get the Architect and Factory Talking Early

Too many projects treat design and production as separate silos. Get the factory involved in the schematic design phase. Educate architects on modular design principles so their drawings are buildable and quote-friendly.

5. Add a “Quote Translator” Role

Some factories are starting to assign dedicated staff to review outgoing quotes for clarity and completeness. That simple quality-control step could save hours of confusion downstream and reduce the number of change orders later.

The Bottom Line

The offsite construction industry sells itself on speed, predictability, and cost control. But when a developer gets three wildly different quotes for the same project, that promise crumbles. If veterans like us struggle to decode them, newcomers don’t stand a chance.

If you continue having trouble understanding a factory quote for your project or home, Bill is here to help.

Bill Murray, experienced Advisor to the Offsite Construction Industry

Sign up for a Free 30-minute Video talk about your company’s future options.