What Early Design Decisions in Offsite Construction Really Decide — and Why Many Teams Learn This Too Late

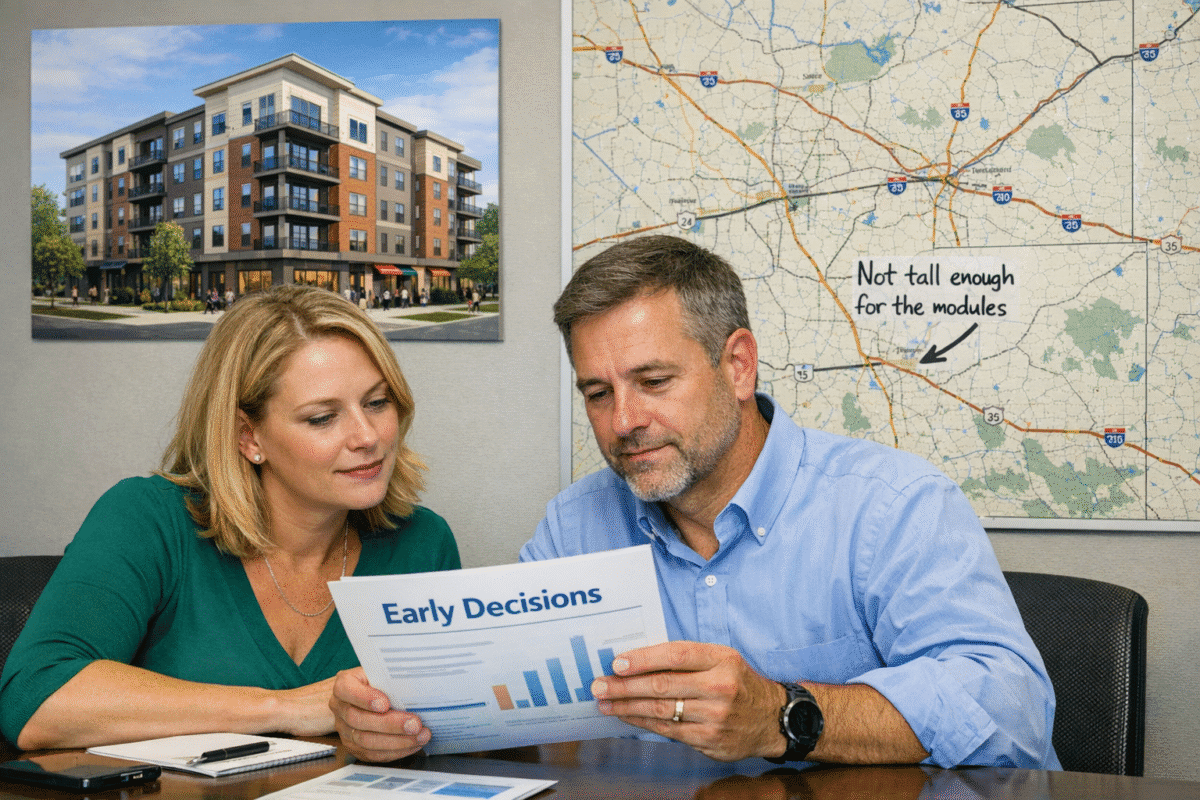

Once builders and developers decide to explore offsite construction, the conversation usually turns quickly to design.

How big can the modules be (or even how small)?

How many can we stack?

Can we push spans, heights, or layouts a bit further?

Those are fair questions. Necessary ones, even.

But after decades inside modular manufacturing and project execution, I’ve learned that size, weight, and dimensional limits are rarely just design questions. They are early signals of much larger consequences—many of which don’t become visible until commitments have already been made.

And that’s where trouble starts.

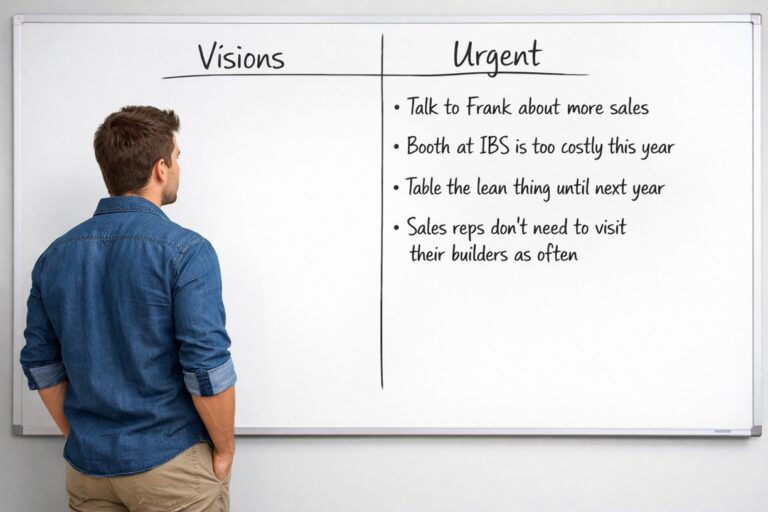

The Mistake Isn’t Asking About Size — It’s Assuming That’s the Whole Question

Builders naturally focus on what they can see: floor plans, elevations, room layouts.

What’s less visible is how those decisions ripple through an entire system.

A few extra feet of width.

A heavier floor assembly.

A taller module to accommodate mechanical runs.

Each of those choices can quietly affect transportation costs, crane requirements, routing approvals, production speed, set sequencing, and even which factories are capable of producing the work in the first place.

The problem isn’t that builders ask about size and weight.

The problem is assuming those answers live in isolation.

They don’t.

Weight Is a Logistics Question Disguised as a Structural One

Weight often gets discussed in terms of structural adequacy—can the floor handle the load, can the framing support the span.

But weight also dictates:

• Transportation equipment

• Axle configurations which dictate the turning radius

• Permitting requirements

• Escort needs that contribute to transportation costs

• Crane size and pick radius

• Site access and staging limitations

Lesson learned:

I’ve seen projects where structural solutions worked perfectly on paper, only to create downstream logistics costs that erased the perceived savings of modular altogether. By the time those costs surfaced, redesign wasn’t an option—only accommodation.

Weight didn’t break the project.

Unanticipated consequences did. (Budgeting for a 100-ton crane, now I need a 150-ton crane)

Dimensions Set Boundaries Long Before the First Module Ships

Module width, length, and height are often treated as factory constraints.

In reality, they are project constraints.

They influence:

• How many units fit on a truck or can multiple loads be considered

• How many trips are required

• Whether over-height or over-width permits apply

• How modules navigate roads, bridges, and jobsite access

• How efficiently modules can be set and stitched together on-site

What many first-time offsite users don’t realize is that two factories with the same square footage can have very different dimensional capabilities—based on equipment, jigs, line layout, and historical product mix.

Assuming “modular is modular” at this stage is a costly oversimplification.

These Are Only Examples — Not the Full List by any means. The list can be extensive.

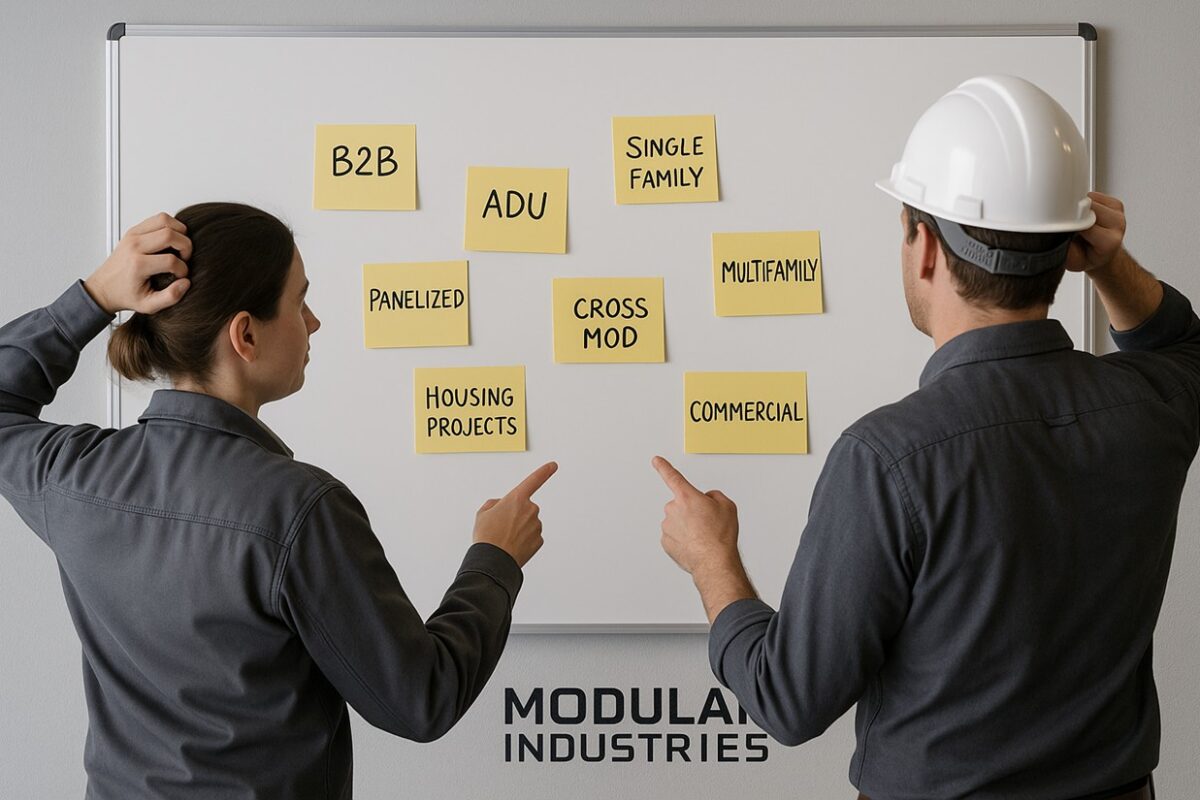

It’s important to be clear: size, weight, and dimensions are only examples of the considerations that matter.

They are visible. Tangible. Easy to ask about.

But behind them sit dozens of interconnected factors: production flow, material handling, weather protection, storage methods, sequencing logic, set crew coordination and their scope of work plus tolerance management—just to name a few.

Builders new to offsite aren’t missing these questions because they’re careless.

They’re missing them because they’ve never had a reason to ask them before.

They don’t know what they don’t know.

And that’s entirely reasonable.

Why Experience Changes the Questions — Not Just the Answers

Experienced advisors don’t approach offsite decisions by running through checklists.

They approach them by asking:

What does this decision trigger next?

If a dimension changes, what breaks?

If weight increases, what becomes more expensive or even not possile?

If production slows, what backs up behind it?

That way of thinking doesn’t come from theory.

It comes from having seen where things go sideways.

The Real Risk Is Discovering Constraints After You’re Committed

Once design advances, deposits are placed, and schedules are communicated, flexibility narrows.

At that point, previously hidden constraints become fixed realities—and learning becomes managing consequences.

That doesn’t mean offsite isn’t viable.

It means early decisions matter more than many first-time users realize.

This Is Why Early Guidance Matters

Offsite construction can deliver tremendous value when approached thoughtfully.

But thoughtful doesn’t mean optimistic.

It means informed.

Builders and developers don’t need to know everything about modular systems.

They just need to recognize when they’re entering territory where experience matters.

Because in offsite construction, the biggest surprises aren’t technical failures.

They’re the things no one thought to ask about—until it was too late.Coming Next:

Why logistics, setting, and financial sequencing—not factory price—often determine whether an offsite project succeeds or struggles.

If you’d like to explore this further, connect with me today.

Bill Murray, Co-Founder of Offsite Innovators